Tesla Inc., led by the visionary Elon Musk, has transformed from a niche electric vehicle (EV) manufacturer into one of the most prominent companies in the world. The company’s journey in the stock market has been equally fascinating, with its stock price experiencing extreme highs and lows. In this article, we will take a deep dive into the history of Tesla’s stock price, examining key milestones, challenges, and the factors that have influenced its rise to prominence.

The Early Years: A Bumpy Ride

Tesla’s Humble Beginnings and IPO

Founded in 2003, Tesla’s early days were far from smooth. The company was initially focused on producing electric vehicles (EVs) that could rival traditional gasoline-powered cars in terms of performance, range, and luxury. Despite the bold vision, Tesla faced significant challenges—ranging from production delays to financing issues.

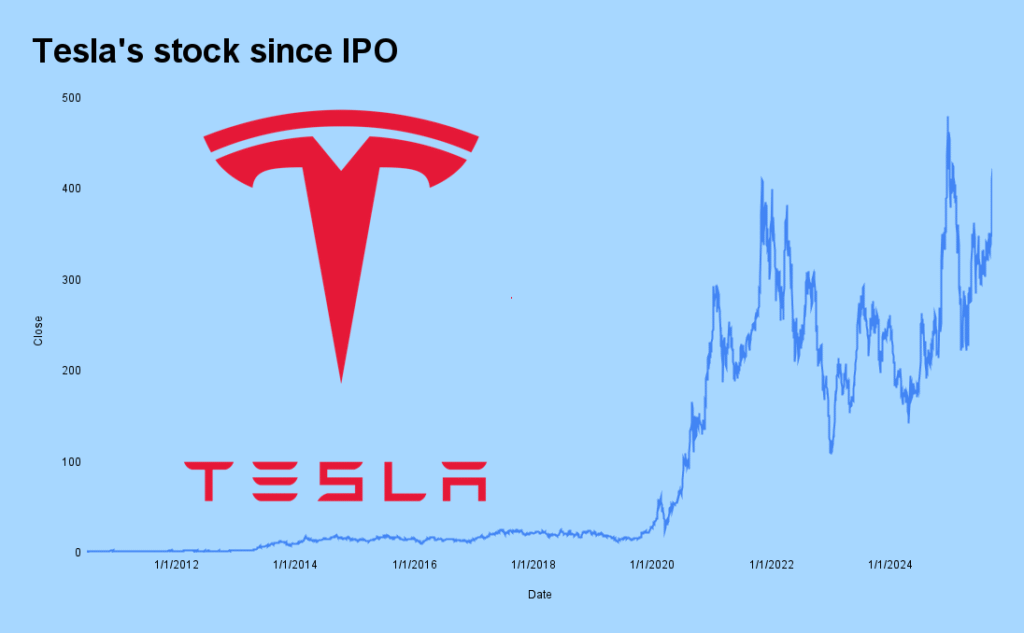

In 2010, Tesla went public with an Initial Public Offering (IPO) at a price of $17 per share. This was a pivotal moment in the company’s history. However, at the time, many analysts and investors were skeptical about Tesla’s long-term viability. The electric car market was still in its infancy, and traditional automakers like General Motors and Ford were dominating the industry. Nevertheless, Tesla’s vision to create a sustainable future through electric transportation set it apart from its competitors.

Early Stock Performance

The first few years following Tesla’s IPO were relatively unremarkable in terms of stock price movement. Between 2010 and 2013, Tesla’s stock traded in a modest range, primarily under $40 per share. The company struggled with production issues, and many investors doubted whether Tesla could ever become profitable.

Tesla’s stock price fluctuated with the release of each new product, including the Roadster and Model S. Despite significant press coverage, the company’s early years were marked by financial instability, which dampened investor confidence.

The Turning Point: The Model S and Investor Confidence

The Launch of the Model S

In 2012, Tesla released its first mass-market electric sedan, the Model S, and this proved to be a major turning point for the company. The Model S was praised for its performance, range, and luxury, and it quickly became a game-changer in the automotive industry. As a result, Tesla’s stock price began to climb.

By 2013, the stock price broke above the $100 mark for the first time, signaling growing investor optimism. Tesla’s success with the Model S led to increased confidence in its ability to mass-produce electric vehicles, and investors began to take the company more seriously. The Model S also helped Tesla overcome some of the skepticism surrounding the electric car market, proving that EVs could be both practical and desirable.

A Surge in Stock Price

From 2013 to 2014, Tesla’s stock price saw a dramatic increase, reaching a high of $265 per share. This period marked a new era for the company. Tesla’s ability to deliver on its promises and its innovative technology attracted the attention of institutional investors, including hedge funds and pension funds. The company’s stock began to be seen not just as a play on the electric vehicle market but also on the future of sustainable energy.

Expansion and New Ventures

In addition to its automotive operations, Tesla also began to diversify its business during this period. The company’s acquisition of SolarCity in 2016 allowed it to expand its footprint in the renewable energy market. Tesla’s solar products, including the Solar Roof and Powerwall, became part of the company’s broader vision of creating a sustainable energy ecosystem. This expansion contributed to further stock price growth as investors saw the potential for Tesla to become a leader in both electric vehicles and clean energy solutions.

The Roller Coaster Ride: Volatility and Challenges

The “Model 3” Moment

In 2017, Tesla launched the Model 3, its most affordable electric vehicle to date. The Model 3 was seen as a critical step toward Tesla’s goal of mass-market penetration. However, the Model 3’s production ramp-up proved to be a significant challenge, and this period was marked by widespread skepticism.

Production delays and quality control issues plagued the Model 3’s rollout, and Tesla’s stock price took a hit as a result. In 2018, Elon Musk’s public behavior and controversial statements, including his infamous “funding secured” tweet about taking Tesla private, only added to the uncertainty surrounding the company. By mid-2018, Tesla’s stock had fallen back to around $300 per share, a significant drop from its 2014 highs.

Tesla’s Recovery and Resurgence

Despite these setbacks, Tesla made a remarkable comeback. By 2019, the company had finally ramped up production of the Model 3, and sales began to take off. Tesla’s ability to meet production targets and deliver vehicles on time helped restore investor confidence. In addition, the company started showing signs of profitability, which boosted its stock price.

Tesla’s stock price surged again, reaching $900 per share in 2020. This was a remarkable achievement considering the company’s history of volatility. Much of this rally was driven by optimism surrounding Tesla’s future prospects, including its plans to enter new markets like China and its ability to expand production with new factories, such as the Gigafactory in Shanghai.

Tesla’s Meteoric Rise: Breaking New Records

The S&P 500 Inclusion

In December 2020, Tesla achieved one of the most significant milestones in its history: the company was added to the S&P 500 index, an event that propelled Tesla’s stock price to even greater heights. The inclusion of Tesla in the S&P 500 was a major vote of confidence from the broader investment community, and it solidified Tesla’s place among the giants of the stock market.

Following this announcement, Tesla’s stock price skyrocketed, breaking $1,000 per share for the first time in January 2021. The Tesla Stock Price History continued to climb throughout 2021, reaching an all-time high of $1,200 per share in late 2021. Investors were eager to capitalize on Tesla’s growth prospects, particularly as the company continued to expand its global footprint and ramp up production.

Factors Driving Tesla’s Stock Price Surge

Several factors contributed to the meteoric rise in Tesla’s stock price in 2020 and 2021:

-

Growth in EV Demand: As global demand for electric vehicles surged, Tesla became one of the primary beneficiaries of this trend. The company’s ability to scale production and deliver EVs on time made it a dominant player in the electric vehicle market.

-

Elon Musk’s Leadership: Elon Musk’s unconventional approach to business and his ability to execute on ambitious plans have played a significant role in shaping Tesla’s narrative. His leadership continues to attract investor enthusiasm and media attention.

-

Strong Financial Performance: Tesla’s increasing profitability, driven by strong sales of the Model 3 and Model Y, coupled with growing margins, bolstered the company’s financial position. This helped attract institutional investors and drive the stock price higher.

-

Sustainability Focus: Tesla’s mission to transition the world to sustainable energy resonates with a growing segment of environmentally conscious investors. The company’s commitment to clean energy solutions, such as solar power and energy storage, aligns with the broader trend toward sustainable investing.

The Future: Will Tesla’s Stock Price Continue to Rise?

Continued Growth in EVs and Beyond

As of 2025, Tesla’s stock continues to be one of the most closely watched stocks in the market. The company is at the forefront of the electric vehicle revolution, and its Tesla Stock Price History will likely continue to be driven by the growth of the EV market. Tesla’s plans for new vehicle models, such as the Cybertruck and the Tesla Semi, could further boost its stock price.

Additionally, Tesla’s continued investments in autonomous driving technology and artificial intelligence (AI) may unlock new revenue streams, further enhancing its market position.

Competition and Market Dynamics

While Tesla is a dominant player in the electric vehicle market, it faces growing competition from traditional automakers, such as General Motors, Ford, and Volkswagen, which are all ramping up their electric vehicle production. Startups like Rivian and Lucid Motors are also entering the market, adding to the competitive landscape.

Tesla’s ability to maintain its lead in the electric vehicle space will be critical to sustaining its stock price growth. Investors will need to keep a close eye on how Tesla navigates these competitive challenges in the coming years.

Conclusion: A Legacy of Innovation

Tesla’s stock price history has been anything but ordinary. From its humble beginnings in 2010 to becoming one of the most valuable companies in the world, Tesla’s journey in the stock market is a testament to its innovation and vision for the future. While the road has been volatile at times, Tesla’s resilience, coupled with its ability to disrupt industries and set new standards, has helped drive its stock price to extraordinary heights.

Whether Tesla’s stock will continue its upward trajectory or experience more volatility in the future remains to be seen. However, one thing is clear: Tesla Stock Price History price history is a reflection of the company’s commitment to pushing the boundaries of what’s possible, and it will continue to captivate investors and market watchers for years to come.